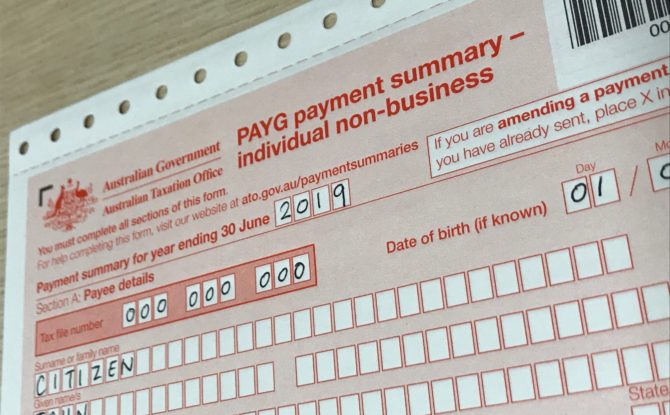

Where is my PAYG Payment Summary?

It’s tax time and everybody is in a hurry to get their tax returns lodged for a nice little surprise refund from the new Low & Middle Income Tax Offset that has recently passed the Parliament and became law.

For those who worked as an employee in the 2019 financial year, you may notice that your employer did not provide you with a PAYG Summary (or Group Certificate). Before storming off to the payroll manager and questioning them, it is nice to know that the law has changed: Single Touch Payroll may now apply to your employer’s business. (What is Single Touch Payroll, or STP?)

For those whose employers have started STP reporting during the 2019 financial year, they are no longer required to provide you with your PAYG Payment Summary (or group certificate). This information will be sent directly to the ATO by your employer. You will then be able to view them through your ATO online services. Aston Accountants as your tax agent will be access to the information so you don’t have to worry about having to print a copy out.

For employers who have not started STP reporting, they will still be required to provide you with your PAYG payment summary by 14 July.

Communication is key: speak to your employer to see if you are expecting a PAYG Summary or not.